All Categories

Featured

Table of Contents

The IRS may, nonetheless, be called for to obtain court consent when it comes to insolvency; see 11 U.S.C. 362. An Internal revenue service levy on a principal residence must be approved in writing by a government area court judge or magistrate. See Internal Revenue Code sections 6334(a)( 13 )(B) and 6334(e)( 1 ). Section 6334 also gives that specific possessions are exempt to an IRS levy, such as certain wearing garments, fuel, furniture and family impacts, specific books and tools of profession of the taxpayer's occupation, undelivered mail, the section of wage, salaries, etc, needed to support small youngsters, and certain various other possessions.

Beginning January 1, 2015, the Mississippi Department of Profits will certainly register tax liens for unpaid tax obligation financial obligations online on the State Tax Lien Computer System Registry. A tax lien recorded on the State Tax Lien Windows registry covers all residential property in Mississippi.

Tax Lien Investing For Dummies

The State Tax Obligation Lien Computer registry is a public site easily accessible on the internet that may be looked by any person at any kind of time. Unlike tax returns, tax liens are a public notification of financial debt.

For an individual noted on the State Tax Lien Registry, any type of genuine or personal home that the person has or later gets in Mississippi goes through a lien. The lien signed up on the State Tax Obligation Lien Computer system registry does not identify a specific piece of building to which a lien uses.

Tax Lien Investing Pitfalls

Tax obligation liens are detailed on your credit scores report and reduced your credit report score, which might impact your capability to get fundings or funding. Mississippi legislation enables extensions on state liens up until they're paid in full; so continuations can be submitted consistently making a tax lien valid forever.

The lien includes the amount of the tax, penalty, and/ or passion at the time of registration. Enrollment of the tax obligation lien provides the Division a lawful right or passion in an individual's property until the obligation is satisfied. The tax lien might affix to genuine and/or personal effects any place situated in Mississippi.

The Commissioner of Profits mails an Evaluation Notification to the taxpayer at his last well-known address. The taxpayer is provided 60 days from the mailing date of the Evaluation Notice to either fully pay the evaluation or to appeal the assessment - invest in tax liens. A tax obligation lien is cancelled by the Department when the delinquency is paid completely

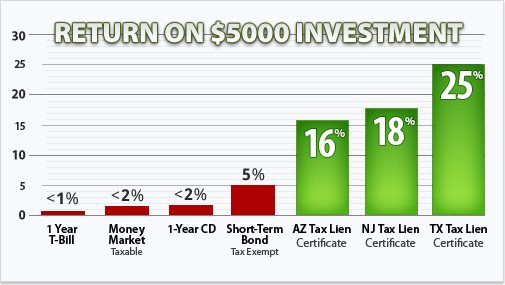

Investing In Tax Lien Certificates

If the lien is paid by any kind of other ways, then the lien is terminated within 15 days. When the lien is cancelled, the State Tax Lien Windows registry is updated to reflect that the financial debt is satisfied. A Lien Termination Notification is mailed to the taxpayer after the financial debt is paid completely.

Enlisting or re-enrolling a lien is not subject to administrative appeal. If the person thinks the lien was filed in mistake, the individual ought to contact the Division of Profits promptly and request that the declaring be examined for correctness. The Division of Profits might request the taxpayer to send paperwork to support his claim.

Latest Posts

Free Tax Lien Sales List

Tax Delinquent Property List

How Long Can You Be Delinquent On Property Taxes