All Categories

Featured

Table of Contents

- – How can Accredited Investor Real Estate Invest...

- – How long does a typical Exclusive Real Estate ...

- – How long does a typical Real Estate For Accre...

- – Who has the best support for Accredited Inves...

- – Accredited Investor Real Estate Crowdfunding

- – What are the top Passive Real Estate Income ...

Rehabbing a residence is considered an energetic financial investment technique - Real Estate Investing for Accredited Investors. You will certainly be in fee of coordinating improvements, overseeing specialists, and inevitably making certain the building offers. Energetic methods require more effort and time, though they are related to big profit margins. On the various other hand, easy realty investing is terrific for investors who wish to take a much less involved approach.

With these approaches, you can enjoy passive earnings with time while enabling your investments to be managed by another person (such as a residential property administration business). The only thing to keep in mind is that you can lose on a few of your returns by working with another person to take care of the financial investment.

An additional consideration to make when picking a real estate investing strategy is direct vs. indirect. Straight financial investments involve actually purchasing or handling residential or commercial properties, while indirect techniques are less hands on. Many financiers can get so captured up in recognizing a residential or commercial property kind that they do not know where to start when it comes to finding a real building.

How can Accredited Investor Real Estate Investment Groups diversify my portfolio?

There are loads of residential properties on the market that fly under the radar because capitalists and property buyers do not recognize where to look. Some of these homes deal with inadequate or non-existent marketing, while others are overpriced when provided and therefore fell short to get any kind of interest. This indicates that those capitalists going to arrange via the MLS can discover a range of investment opportunities.

By doing this, capitalists can regularly track or be alerted to brand-new listings in their target location. For those asking yourself just how to make connections with realty agents in their corresponding areas, it is a good concept to participate in local networking or property event. Capitalists looking for FSBOs will also find it advantageous to collaborate with a property agent.

How long does a typical Exclusive Real Estate Crowdfunding Platforms For Accredited Investors investment last?

Financiers can likewise drive via their target areas, searching for indications to find these homes. Keep in mind, recognizing residential or commercial properties can require time, and investors ought to be prepared to employ several angles to safeguard their next bargain. For investors living in oversaturated markets, off-market residential or commercial properties can stand for an opportunity to be successful of the competitors.

When it comes to looking for off-market homes, there are a few resources financiers ought to inspect. These include public documents, genuine estate auctions, dealers, networking events, and service providers.

How long does a typical Real Estate For Accredited Investors investment last?

Years of backlogged foreclosures and boosted inspiration for banks to reclaim can leave also a lot more repossessions up for grabs in the coming months. Investors looking for foreclosures should pay mindful focus to paper listings and public records to discover prospective residential properties.

You need to consider spending in genuine estate after learning the numerous advantages this asset has to provide. Generally, the constant demand uses genuine estate reduced volatility when contrasted to various other investment types.

Who has the best support for Accredited Investor Real Estate Investment Groups investors?

The factor for this is since genuine estate has reduced connection to other financial investment kinds hence supplying some protections to financiers with other property kinds. Different kinds of property investing are connected with various degrees of threat, so make sure to locate the appropriate financial investment approach for your goals.

The procedure of getting residential property involves making a down payment and funding the remainder of the price. Consequently, you only spend for a tiny portion of the building in advance but you manage the whole financial investment. This kind of utilize is not available with various other financial investment kinds, and can be utilized to further grow your financial investment portfolio.

Due to the vast selection of choices readily available, lots of investors most likely find themselves questioning what truly is the best real estate investment. While this is a straightforward question, it does not have a straightforward response. The very best kind of investment residential property will certainly rely on many elements, and investors ought to take care not to eliminate any choices when searching for prospective offers.

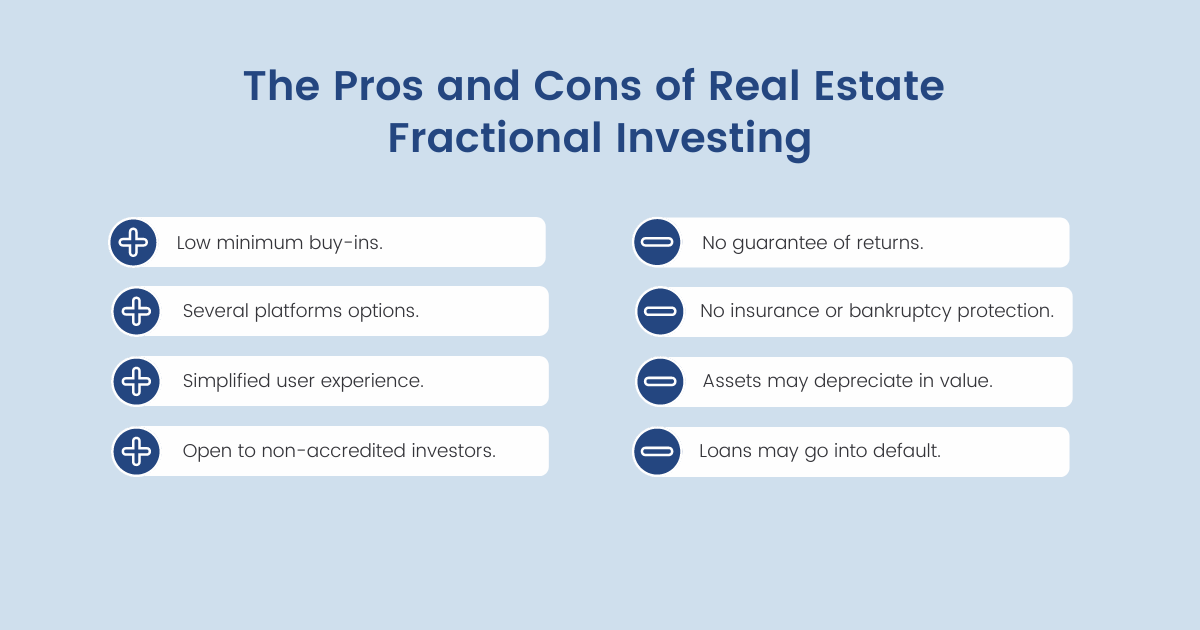

This short article explores the opportunities for non-accredited financiers aiming to venture right into the rewarding realm of realty (Real Estate Investment Funds for Accredited Investors). We will certainly delve into numerous financial investment avenues, regulatory factors to consider, and approaches that encourage non-accredited individuals to harness the possibility of realty in their financial investment portfolios. We will likewise highlight how non-accredited investors can function to become certified financiers

Accredited Investor Real Estate Crowdfunding

These are usually high-net-worth individuals or business that satisfy accreditation requirements to trade personal, riskier investments. Income Requirements: People must have a yearly income exceeding $200,000 for two consecutive years, or $300,000 when combined with a partner. Net Worth Requirement: A total assets surpassing $1 million, excluding the key residence's worth.

Financial investment Knowledge: A clear understanding and recognition of the threats related to the financial investments they are accessing. Paperwork: Capability to give monetary statements or other paperwork to confirm income and total assets when asked for. Real Estate Syndications need certified capitalists because sponsors can only permit accredited investors to register for their investment opportunities.

What are the top Passive Real Estate Income For Accredited Investors providers for accredited investors?

The first typical false impression is as soon as you're a recognized investor, you can keep that standing indefinitely. To end up being a certified financier, one need to either hit the income criteria or have the internet worth need.

REITs are attractive because they yield more powerful payments than conventional supplies on the S&P 500. High yield rewards Portfolio diversification High liquidity Dividends are taxed as common revenue Sensitivity to rate of interest Dangers connected with details properties Crowdfunding is a method of on-line fundraising that entails requesting the general public to add money or start-up funding for new projects.

This enables business owners to pitch their concepts directly to daily net customers. Crowdfunding offers the capability for non-accredited investors to come to be shareholders in a firm or in a realty residential or commercial property they would certainly not have actually had the ability to have accessibility to without accreditation. One more benefit of crowdfunding is profile diversity.

In numerous instances, the financial investment applicant requires to have a track document and is in the infancy stage of their job. This could indicate a higher threat of shedding a financial investment.

Table of Contents

- – How can Accredited Investor Real Estate Invest...

- – How long does a typical Exclusive Real Estate ...

- – How long does a typical Real Estate For Accre...

- – Who has the best support for Accredited Inves...

- – Accredited Investor Real Estate Crowdfunding

- – What are the top Passive Real Estate Income ...

Latest Posts

Free Tax Lien Sales List

Tax Delinquent Property List

How Long Can You Be Delinquent On Property Taxes

More

Latest Posts

Free Tax Lien Sales List

Tax Delinquent Property List

How Long Can You Be Delinquent On Property Taxes